It’s hard post to write, but on Friday I sold most of my remaining shares of Tucows. Last year – before the reverse split I sold a little more than half, and just now I sold most of the rest.

I invested in Tucows back in 2005 or 2006 for reasons which were admittedly, more emotional than savvy. As I began to learn more about investing and in particular, drank the value investing Kool-Aid , I added considerably. Specifically in 2008 I realized that a conservative valuation of their aftermarket domain portfolio (a.k.a “Yummynames”, before Yummynames actually existed) was worth more than twice the actual market capitalization of the entire company. It was surprising to find such a textbook value investment so close to home, but after I got over that it was easy to pile in and buy more, and more, at an average cost of $0.65/share (or $2.60 post-reverse-split adjusted) finally doubling down in 2012 at roughly $1/share (or $4 post-reverse-split).

Selling Tucows after being a shareholder for over a decade was hard. Canadian value investing guru Irwin Michaels expands on why “selling is hard” in his interview in “Stock Market Superstars: Secrets of Canada’s Top Stock Pickers” (cheesy title, good book): Read more »

In the face of soaring complacency and optimism I am lightening up some equity positions and taking profits. To the left we see the VIX at near lowest levels since just prior to the onset of the GFC. With markets challenging their all-time highs, I would feel more comfortable with an ascending VIX, not a descending one.

In the face of soaring complacency and optimism I am lightening up some equity positions and taking profits. To the left we see the VIX at near lowest levels since just prior to the onset of the GFC. With markets challenging their all-time highs, I would feel more comfortable with an ascending VIX, not a descending one.

This tells me that confidence and complacency are high. I am also seeing a lot of scorn directed at those who seem to agree with me, combined with numerous rationalizations on why the markets have nowhere to go but up. For instance, some guy on twitter has deemed this “crass contrarianism” as “silly”, and people are pretty eager to agree.

So it’s time for me to take some profits off the table, including RIM – thanks for the easiest double+ ever. I once again made my cardinal investing error and wished I had bought more. I also lightened up a few of my Euro indexes and took profits on Portugal Telecom.

I should also mention I sold some of my beloved Tucows. I had a small position in another trading account I decided to liquidate for a tidy gain but I am still long and strong a much larger position within my RRSPs and plan to keep adding there when the circumstances present themselves.

Read more »

Tucows has been on a tear lately, up about 55% since my last article “Are Domaining Stocks About to Break Out” a little over a month ago. After taking a bit of a breather the last couple weeks it got some renewed energy today on what I am assuming are run-off speculations that after the big Demand Media news this morning. After being up nearly 15% over part of the day, it has cooled off to a mere 10% gain on 4X the volume.

Read more »

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

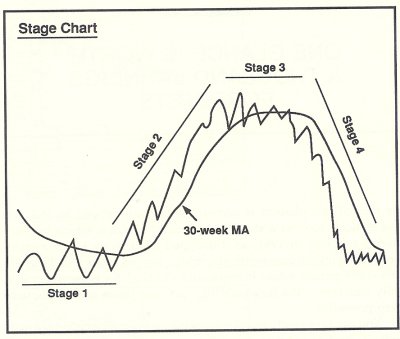

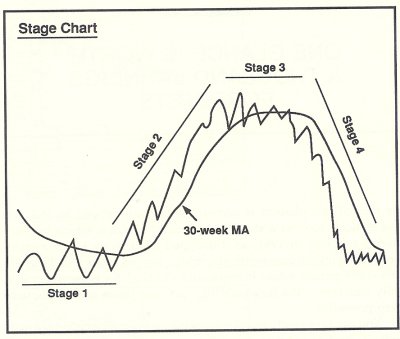

I know, value investors don’t “do charts” and eschew technical analysis, but even though I’m a value investor I still occasionally commit heresy and give credence to the Stan Weinstein school of the “4-phase stock cycle”, as described in his seminal work “Secrets for Profiting in Bull & Bear Markets” (and revisited in Mike Swanson’s “Strategic Stock Trading“).

Tucows, Demand Media and Web.com all reported this week and they all delivered good news to shareholders. When you look at the charts, they all appear to be on the cusp of a Stage 2 bull run:

Publicly Traded

|

Publicly Traded

|  Demand Media, DMD, domaining stocks, Marchex, Mike Swanson, Stan Weinstein, TCX, Tucows, verisign, Web.com, WWWW

Demand Media, DMD, domaining stocks, Marchex, Mike Swanson, Stan Weinstein, TCX, Tucows, verisign, Web.com, WWWW

I was going to comment directly on Domain Stryker’s article about Godaddy’s vs NetSol’s respective price tags, until I read that he was putting me on the spot to say something half clueful about it over here 🙂

My initial comment was to the key differences between the prospect of Godaddy being bought for 1 Billion today and Verisign’s purchase of Network Solutions for 28B back in the dotcom heyday was this: Network Solutions included the registries for .COM, .NET and .ORG.

ICANN later forced Verisign to divest out of the registrar side if they wanted to renew their contract for the registry (and they were also forced to let go of .ORG as well)

So for 28B, Verisign got the .COM and .NET registries, for what looks like in perpetuity. No matter how big Godaddy ever gets, at $8.88 a domain or so, they will always be paying the lions share of it to Verisign (well, for .COM and .NET’s)

That’s not to say Verisign got a bargain on NetSol. They locked up the registry, but given the times, everybody was paying nosebleed valuations for everything, but consider this:

Read more »

Tucows has just announced another Dutch Auction to repurchase 2,900,000 shares of it’s stock in a Dutch Auction ranging from .61 to .70 / share, commencing next week.

This comes on the heels of a long line of regular share repurchases and another Dutch Auction last year. Tucows has been steadily reducing its outstanding shares for a few years now.

Disclosure: Long Tucows.

Briefly: Tucows just posted their second quarter results. While net revenues and deferred revenues were up modestly, they posted a loss on forex losses (read: weak US dollar) and because the second quarter from last year included one-time items like their divestment from Afilias and a patent assignment.

Read more »

Bill Sweetman manages the Tucows YummyNames domain portfolio, and Tucows’ office is right down the street from mine. So after reading my articles on domain investing and Tucows, Bill suggested we meet for lunch. We hadn’t met in person until now even though we’ve been working in close proximity for awhile.

Over the course of our lunch we talked about managing aftermarket domain portfolios, and the higher margin business of selling domains to end-users at retail prices. When your cost basis is low (and in Tucows’ case it is basically the cost of wholesale registrar registration), it doesn’t take much to lock in healthy margins and decent profits.

5 key takeaways came out of our meeting, and Bill was good enough to expand on some of them via email later:

- Read more »

Shadowstock is a another very interesting niche blog that covers “Deep Value Micro Cap Investing” and I’ve been following it for awhile. Once of his more recent ideas as a possible Ben Graham net/net is Looksmart (Nasdaq:LOOK), the “second tier” Pay-Per-Click search engine.

Read more »

So, a lot of comments from the peanut gallery around my last post. Seems like people take it quite hard when you suggest that they may be throwing money into something without a sound basis for it and calling it “investing”.

Looking over Tucows annual report we find that classic setup that really can make domain names the single greatest investment in the world.

From the notes to the financial statements we find that Yummynames added anywhere between nearly 5 and 7 million dollars in revenues to Tucows operating performance over each of the last three years, that’s basically about 17 million dollars in revenue over 3 years (or a combined 25 cents a share over 3 years, currently trading around 72 cents).

Read more »

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)