It’s hard post to write, but on Friday I sold most of my remaining shares of Tucows. Last year – before the reverse split I sold a little more than half, and just now I sold most of the rest.

I invested in Tucows back in 2005 or 2006 for reasons which were admittedly, more emotional than savvy. As I began to learn more about investing and in particular, drank the value investing Kool-Aid , I added considerably. Specifically in 2008 I realized that a conservative valuation of their aftermarket domain portfolio (a.k.a “Yummynames”, before Yummynames actually existed) was worth more than twice the actual market capitalization of the entire company. It was surprising to find such a textbook value investment so close to home, but after I got over that it was easy to pile in and buy more, and more, at an average cost of $0.65/share (or $2.60 post-reverse-split adjusted) finally doubling down in 2012 at roughly $1/share (or $4 post-reverse-split).

Selling Tucows after being a shareholder for over a decade was hard. Canadian value investing guru Irwin Michaels expands on why “selling is hard” in his interview in “Stock Market Superstars: Secrets of Canada’s Top Stock Pickers” (cheesy title, good book): Read more »

Tucows has been on a tear lately, up about 55% since my last article “Are Domaining Stocks About to Break Out” a little over a month ago. After taking a bit of a breather the last couple weeks it got some renewed energy today on what I am assuming are run-off speculations that after the big Demand Media news this morning. After being up nearly 15% over part of the day, it has cooled off to a mere 10% gain on 4X the volume.

Read more »

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

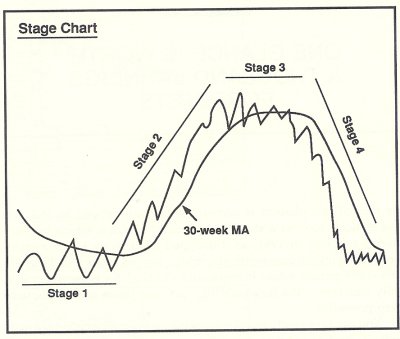

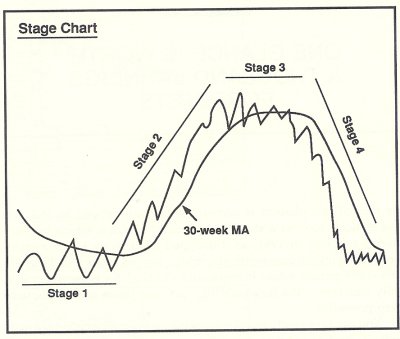

I know, value investors don’t “do charts” and eschew technical analysis, but even though I’m a value investor I still occasionally commit heresy and give credence to the Stan Weinstein school of the “4-phase stock cycle”, as described in his seminal work “Secrets for Profiting in Bull & Bear Markets” (and revisited in Mike Swanson’s “Strategic Stock Trading“).

Tucows, Demand Media and Web.com all reported this week and they all delivered good news to shareholders. When you look at the charts, they all appear to be on the cusp of a Stage 2 bull run:

Publicly Traded

|

Publicly Traded

|  Demand Media, DMD, domaining stocks, Marchex, Mike Swanson, Stan Weinstein, TCX, Tucows, verisign, Web.com, WWWW

Demand Media, DMD, domaining stocks, Marchex, Mike Swanson, Stan Weinstein, TCX, Tucows, verisign, Web.com, WWWW

In Brief: Demand Media has filed an amended S1 to their IPO. I don’t have a lot of time to look at the differences, but I thought I’d mention it for those who are interested. Could make for some interesting weekend reading.

There has been a lot of coverage in domainer circles (and beyond) of Demand Media’s S1, most of which run along the theme “Demand Media is losing money, why would anybody invest”. Which is a good question. I remarked the same back when Godaddy’s S1 revealed that even though they were the largest registrar in the world, they too were operating at a loss.

Read more »

A new batch of Oversee.net shares just listed on sharespost at 4.37/share, placing the company valuation at 760 million. This is down 32% from earlier share offers at $7.35/share which would have put the company at 1.16 billion. Kinda, sorta. No recent transactions have actually taken place, just offers. So we don’t truly know an imputed value of Oversee until we see a sale actually take place.

Read more »

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)