Tucows aftermarket revenues vs. costs: This is what I’m talking about.

So, a lot of comments from the peanut gallery around my last post. Seems like people take it quite hard when you suggest that they may be throwing money into something without a sound basis for it and calling it “investing”.

Looking over Tucows annual report we find that classic setup that really can make domain names the single greatest investment in the world.

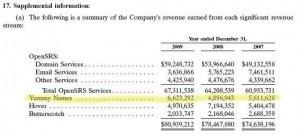

From the notes to the financial statements we find that Yummynames added anywhere between nearly 5 and 7 million dollars in revenues to Tucows operating performance over each of the last three years, that’s basically about 17 million dollars in revenue over 3 years (or a combined 25 cents a share over 3 years, currently trading around 72 cents).

So how much did it cost Tucows to acquire the domains they sold via Yummynames? A couple million? A couple hundred thousand? Either of those numbers would represent 850% or a 8,500% return on their outlay. Not bad.

Well, forget those numbers. Tucows spent a grand total of under $47,000 on “Cost of Domain Names Acquired” from their Statement of Cashflows. I believe this represents the cost of grabbing the expired domains from the wholesale registrar channel. Granted, the outlay on these domains here does not translate directly into the same revenues received (i.e. some of the domains they sold this year would have been acquired in some other year), but you see the stark contrast between cost of acquisition and returns on sale.

This is how you make money in the domain aftermarket folks. The legends in the industry did it by loading up on the expiring domains back about 10 years ago. If you didn’t do it then, you missed it. So did I. Today it’s being done by the Registrars. Tucows is the largest publicly traded Registrar in the world, and from where I’m sitting none of this is priced into the stock.

DISCLOSURE: Long Tucows

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)