Are Domaining Stocks Breaking Out?

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

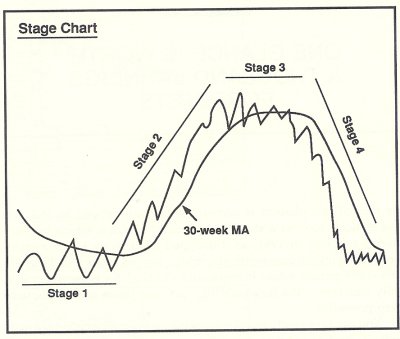

I know, value investors don’t “do charts” and eschew technical analysis, but even though I’m a value investor I still occasionally commit heresy and give credence to the Stan Weinstein school of the “4-phase stock cycle”, as described in his seminal work “Secrets for Profiting in Bull & Bear Markets” (and revisited in Mike Swanson’s “Strategic Stock Trading“).

Tucows, Demand Media and Web.com all reported this week and they all delivered good news to shareholders. When you look at the charts, they all appear to be on the cusp of a Stage 2 bull run:

Tucows

Tucows had a sharp move on volume after reporting this week. Tucows has been exhibiting a Stage 1 basing pattern for months. What is interesting here is that during the minor meltdown in August, I put in orders for more shares just under .70 cents, hoping for a dip into the .60’s to add to my position. None of them were ever filled.

Tucows had a sharp move on volume after reporting this week. Tucows has been exhibiting a Stage 1 basing pattern for months. What is interesting here is that during the minor meltdown in August, I put in orders for more shares just under .70 cents, hoping for a dip into the .60’s to add to my position. None of them were ever filled.

This leads me to believe that the stock is held largely by stronger hands and is being accumulated. On top of this, Tucows continues to reduce the float via ongoing share buy backs.

While Tucows often displays a moderate “run up” ahead of earnings, or sometimes pops for a few days immediately after, this time it gapped up the next day, traded up nearly 16% in two days on over 2x the normal volume.

What’s more is it looks pretty close to a “golden cross”, where the 50-day moving average looks ready to cross higher over the 200 day MA.

Demand Media

I just lost money shorting Demand Media, as some PUT options I bought last summer expired today. The stock did go down, but not down enough. This was my mistake as I normally buy options “at-the-money” and if I had done that instead of cheaping out and buying them out-of-the-money, I would have done alright.

I just lost money shorting Demand Media, as some PUT options I bought last summer expired today. The stock did go down, but not down enough. This was my mistake as I normally buy options “at-the-money” and if I had done that instead of cheaping out and buying them out-of-the-money, I would have done alright.

Looking at the technicals of the chart, it’s pretty obvious I was late to the game shorting DMD and entered my position (when you look at it from a 4-stage analysis), about the time it seems to have entered a good solid, stage-1 base.

DMD’s pop this week on earnings is probably not a breakout into a stage 2 bull, not yet. The 50-day and 200-day MA’s are still sloped down, but the base-building looks promising.

Web.com

I have not been following Web.com too much. They now own both Register.com and Network Solutions and seem to be building a decent portfolio of web business units. I notice at some point they also acquired 1shoppingcart.com. (You would really have to look at their acquisition strategy though, I have no idea if they’re levering up to do all this or what. Remember, I’ve taken off my “value investor” hat for this post 🙂 )

Web.com is in a Stage 2 bull now, we see the 50 over 200 MA cross happened a couple months ago, the uptrend is healthy. They also had a gap up after earnings…could it be a breakaway gap up?

Putting it all together.

We have 3 “domaining” type companies releasing strong earnings this week, enjoying gap ups and in varying stages of Stage 1 basing, possible break outs into Stage 2 and one Stage 2 in progress.

Before I was simply looking at Tucows, since I have been long Tucows a long time, but the three of them together could be indicative of a wider sector move.

Risks: Many people think that the wider overall market is ready to roll-over. I agree with this and lightened up my positions within a few of my RRSP accounts lately. If macro events like a Greek default or something else bring on a correction, then everything will probably go down. As Marc Faber noted in a recent issue of GloomBoomDoom, for the last few years correlation among sectors has been at an all-time high.

Still, these charts are telling me an interesting story. Of other sector participants, two come to mind: Verisign and Marchex. Verisign is also in a healthy uptrend but it could be quite mature, perhaps petering out with the rest of the broad market. And Marchex still looks just plain awful. Nobody following a Weinstein “4 phase” approach would touch it.

Disclosures:

- Tucows: Long

- Demand Media: Recently short

- Web.com: No Position

- Verisign: Recently Long

- Marchex: No Position

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)