It’s hard post to write, but on Friday I sold most of my remaining shares of Tucows. Last year – before the reverse split I sold a little more than half, and just now I sold most of the rest.

I invested in Tucows back in 2005 or 2006 for reasons which were admittedly, more emotional than savvy. As I began to learn more about investing and in particular, drank the value investing Kool-Aid , I added considerably. Specifically in 2008 I realized that a conservative valuation of their aftermarket domain portfolio (a.k.a “Yummynames”, before Yummynames actually existed) was worth more than twice the actual market capitalization of the entire company. It was surprising to find such a textbook value investment so close to home, but after I got over that it was easy to pile in and buy more, and more, at an average cost of $0.65/share (or $2.60 post-reverse-split adjusted) finally doubling down in 2012 at roughly $1/share (or $4 post-reverse-split).

Selling Tucows after being a shareholder for over a decade was hard. Canadian value investing guru Irwin Michaels expands on why “selling is hard” in his interview in “Stock Market Superstars: Secrets of Canada’s Top Stock Pickers” (cheesy title, good book): Read more »

I got a few comments from my “Tech Pair Trade of the Century” post awhile back along the lines of “Short AAPL? Good luck!” and “Long RIM? Good luck!”.

So it was with interest I noted this week (13F week, when all the “big boys” file their 13-F’s with the SEC) that two very large heavy hitters are calling it quits with AAPL: Read more »

Briefly, RIMM blew out expectations today with 2.9B in revenues and an adjusted net loss narrowed to .27/share. Expectations were for .47/share loss on 2.45B in revenues. Blackberry sales were stronger than expected and the company added 100M in net cash.

Read more »

I just received a short report from Citron Research (another financially uber-astute easyDNS client 😉 ) which outlines a scathing short thesis for Web 2.0 real estate darling Zillow (Nasdaq: Z).

Read more »

So far the only comment on my post about going long RIM is “good luck with that”. So far so good there.

My pet quip about value investing is that your investing thesis looks good if it passes what I call the “double idiot test”. That is, you get called an idiot for buying, and then you get called an idiot again for selling. Read more »

I have long since thought that RIM was going through an unprecedented bout of negativity which has had it on my “watch list” for months. Contrarians love this type of stock, John Templeton always tried to “buy at the point of maximum pessimism” (there is a good book by that title, and you may also enjoy reading “Investing The Templeton Way”.)

I have long since thought that RIM was going through an unprecedented bout of negativity which has had it on my “watch list” for months. Contrarians love this type of stock, John Templeton always tried to “buy at the point of maximum pessimism” (there is a good book by that title, and you may also enjoy reading “Investing The Templeton Way”.)

Sir Templeton earned his wings as a legendary value investor by borrowing $40,000 from his boss during the nadir of the Great Depression and using it to purchase shares of every single company trading under $1. The rest is history.

These days the legends have different names, like Prem Watsa, who already owned a significant stake in RIM and then went ahead and doubled down. Read more »

Tucows has been on a tear lately, up about 55% since my last article “Are Domaining Stocks About to Break Out” a little over a month ago. After taking a bit of a breather the last couple weeks it got some renewed energy today on what I am assuming are run-off speculations that after the big Demand Media news this morning. After being up nearly 15% over part of the day, it has cooled off to a mere 10% gain on 4X the volume.

Read more »

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

I was planning on writing a post for awhile on how a nice domaining pair trade would be “long Tucows / short Demand Media”, but when I looked at the charts, it didn’t look like such a good pair trade any more.

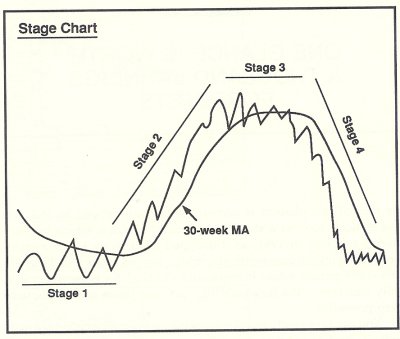

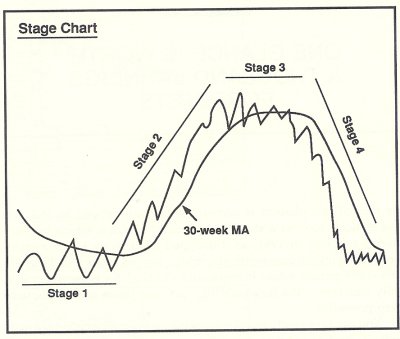

I know, value investors don’t “do charts” and eschew technical analysis, but even though I’m a value investor I still occasionally commit heresy and give credence to the Stan Weinstein school of the “4-phase stock cycle”, as described in his seminal work “Secrets for Profiting in Bull & Bear Markets” (and revisited in Mike Swanson’s “Strategic Stock Trading“).

Tucows, Demand Media and Web.com all reported this week and they all delivered good news to shareholders. When you look at the charts, they all appear to be on the cusp of a Stage 2 bull run:

Publicly Traded

|

Publicly Traded

|  Demand Media, DMD, domaining stocks, Marchex, Mike Swanson, Stan Weinstein, TCX, Tucows, verisign, Web.com, WWWW

Demand Media, DMD, domaining stocks, Marchex, Mike Swanson, Stan Weinstein, TCX, Tucows, verisign, Web.com, WWWW

Cyberplex.com (TSX:CX) is Canada’s largest CPA network with a fairly blue-chip customer base including RBC and Jaguar along with net giants like eHarmony and Netflix. They’ve been pretty aggressively growing revenues and earnings over the past couple years and for awhile I counted myself a shareholder. I sold my position last year when they announced their acquisition of Tsalvo (which was once upon a time Geosign). It was highly dilutive to shareholders (expanding the shares outstanding from roughly 80M to 120M+) and I’m not a fan of traffic arb plays because the earnings (while often explosive) are extremely volatile. Read more »

It was just pointed out to me that Banks.com has entered into a sale/leaseback arrangement with Domain Capital for their flagship domain, banks.com.

Read more »

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)