Latest Oversee.net offer price places value at 760M (down 32%)

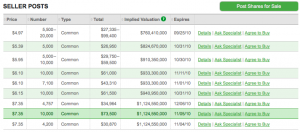

A new batch of Oversee.net shares just listed on sharespost at 4.37/share, placing the company valuation at 760 million. This is down 32% from earlier share offers at $7.35/share which would have put the company at 1.16 billion. Kinda, sorta. No recent transactions have actually taken place, just offers. So we don’t truly know an imputed value of Oversee until we see a sale actually take place.

Like all non-public (yet) companies listed on sharespost, these offers preceed of a generally anticipated, eventual Oversee IPO.

BusinessInsider estimates their annual revenues to be in the $200 million area, and from there they assign a “1 billion dollar valuation” based on 5X revenues. My problem with these yet-to-be-public companies is the opacity of their financial condition. A multiple of an estimate of annual revenues just isn’t enough for me to make a semi-intelligent decision or to arrive at a halfway coherent valuation. What are the earnings? When Godaddy filed their S1 back in 2006 it turned out they were losing money. Demand Media is expected to file theirs at some point this year, in a much anticipated IPO that is being heralded as the first billion dollar tech IPO since Google. Alas, there are no shares for Demand Media currently offered on Sharespost, so we can’t do a rough comparison with Oversee on that front.

Personally, I suspect that some of these domain parking and “new media” companies are near obscenely profitable. In fact, I think that’s why we see so few of them being traded publicly: they’re making too much money to let anybody else in on the deal. But I could be way off base.

Going public is supposed to be a way for companies to raise capital in order to expand. Nowadays it is used primarily as an exit vehicle for the VC’s and shareholders. The “exit” is seen as the end-in-itself. In many cases the relentless drive toward the IPO takes more precedence than driving actual profits. So instead of building profitable, viable enterprises that may need capital to expand, the companies concern themselves with securing numerous funding rounds at successively higher valuations, culminating in the big cash-out IPO (Twitter, Facebook, etc).

Oversee.net has only done one A series financing of 150M, one of the things I appreciate about them, as they seem to be in the actual business of their core business, not professional funding round recipients.

But I digress. The crucial element we are missing here is a valuation methodology for Oversee.net. I like Oversee a lot, I also like Demand Media. I think they are both great companies with a lot of amazing business units. But as value investors, we can never let our admiration for a company get in the way of buying it at a decent price. Google is also an amazing company, but it isn’t a value candidate at current prices.

I think at the moment the best we can hope for with Oversee is that they eventually file an S1 so we can get a good look at their internals and put a value on them. From there, we can impute our desired price target (typically: 33% discount to intrinsic value), and then we add it to our value watch list, and wait for a price to value mismatch (via a flash crash, irrational overreaction to news, or general market volatility) to offer up our chance to buy in at that price.

Until we can sanely value Oversee, all we can do is admire it from afar, and wait for more info.

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)