Online, offline, value-investing still requires a wide moat.

A lot of people want to “invest” in websites and domain names. As value investors we have the same requirements for an online investment as we do for an offline one or a publicly traded equity:

- We can buy it for less than it’s intrinsic worth

- Safety of principal combined with reasonable return

- A durable competitive advantage or a wide-moat

Between these three simple criteria, we can eliminate probably 99% of the “opportunities” we see out there to “invest” in a web business or a domain name….

Take for example the following website, earning $400/month with a BIN (Buy-It-Now) price of $2,999 at Flippa.

On the surface, this looks interesting, the site is ostensibly on track to making $4800/year (although that is only based on the most recent 1 month’s earnings) and you can BIN for $3000. Given that a lot of cash producing websites typically sell for a year or two of earnings, we’re getting a discount. Or are we?

It goes without saying, if it looks too good to be true, it usually is. In this case, we find a number of weaknesses with the business model of the website. While some weaknesses can explain away a discount, one that may be addressed post-acquisition to enhance your margin-of-safety (i.e. sometimes the current owner has a problem with the website that he can’t solve, one that causes the price to go down, but if you can solve that problem – you can instantly add value just by buying that website).

Here are the problems that I find with this particular “opportunity”:

- The website has only been in existence for 4 months. It’s too short a timeframe to truly understand how this business will weather the incessant changes of the internet environment. In this sort of a situation, if the website hasn’t existed more than a year, I wouldn’t pay any more than the earnings to-date, and that would be my top offer. I’d work down from there.

- It’s an affiliate site. It’s not actually rendering the service it’s offering, it’s just selling through to a clickbank affiliate. So your core product offering is something outside your control. That clickbank product could change the payout, stop paying out, or go out of business, be sold, change models.

- Most importantly: it’s an easily replicable service that is quite frankly, a dubious product. There is no “moat” here at all. I could replicate this entire business (the core, “email finder” business, not even the affiliate satellite), in about an hour.

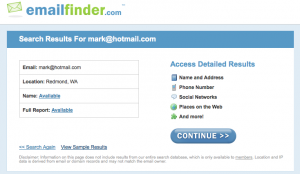

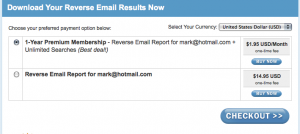

All the service does it take an email address, parse it into the userid and the domain name, probably does a whois lookup on the domain name to harvest address info and contact info for the domain name itself (which may have little to do with the actual email address itself), does a geo-ip lookup on the domain name, and then tries to offer you a continuity product or an inflated one-time fee for this.

So, despite the fact that there are enough people out there that will pay money for this. This is a business model that borders on vaporware. It is easily replicable, there are many free alternatives, and it relies on the ignorance of the end user to make a sale. (Personally, I prefer to be involved in businesses where the end-user being smart is to my advantage, not the other way around).

A big part of value investing is looking at a lot of opportunities and then passing on them. Remember, “fat pitches” don’t come every day. A big part of employing value investment approach to any asset (but especially online ones) is finding the problems and ruling them out.

For example, over the last couple weeks I went through an extensive due diligence process on a website I very much was interested in buying only to rule it out in the end. It would have been in the range between $30,000 and $40,000 and it didn’t have near the problems this website does. It’s been in business for years, dominates its niche and throws off a decent amount of cash. It was a lot more solid and lot more viable and I still didn’t do it. I’ll explain why in another post, but hopefully this one scratched the surface on what hurdles web businesses need to meet in order to be seriously considered.

Alas, investing in web assets involves a lot of separating the wheat from the chafe, sifting through endless flippa listings, creating ebay filters, and basically keeping your ear to the ground, only to find maybe a handful of interesting prospects a year and maybe having a couple of them pass due diligence into a purchase.

![[PHOTO: sales book]](http://webvalueinvestor.com/wp-content/themes/WebValueInvestor/images/sales_book.gif)